Google’s First Step…

As reported and since confirmed by Greg Sterling, Google is now showing up to 10 local business results for geographic specific queries.

Google told Greg the reason it’s showing more links is because usability testing revealed that many people didn’t realize there was additional local content available beyond the three listings, despite the “more results . . .” prompt. Accordingly, Google said that with the 10 links it is hoping to signal people that there is much more local content a click away.

Google also said that it wouldn’t always show 10 results; it might still show three sometimes or one if the query is very specific.

As Mike Blumenthal has noted, it has been nearly a year since Google last upgraded their Local OneBox. At the time it led to a significant increase in Google Maps usage.

It will be interesting to see if and how Google’s worldwide roll out of their new Local OneBox increases Google Maps usage like it did after implementing their last Local Business OneBox changes.

In my previous post about Google’s local business results being expanded, I wrote about how the listings appeared locally and some of the factors I thought contributed to the listings.

Sterling reported the ten results are based on a range of factors, including the “query, proximity, availability of ratings/reviews and their quality and several other variables.”

Since Google doesn’t publish exactly what factors influence their list, all we can do is study what they publish and draw our own conclusions as to which variables may matter the most.

The following are examples of searches I have ran, Google’s Local OneBox business results and my analysis of what variables I think generated the list.

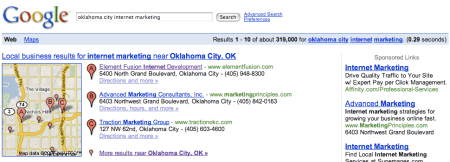

Google Local Business Results: Internet Marketing Oklahoma City –

This query for a service (internet marketing) followed by the location (Oklahoma City) produced a “top of page” 10 listings OneBox result. I also found some Google Adwords ads displaying the recently discovered business address on the fourth line of the Adwords ad.

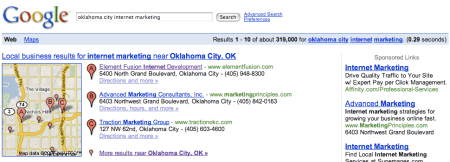

Google Local Business Results: Oklahoma City Internet Marketing –

Searching for the same terms in a different order; placing the location first (Oklahoma City) and the service (internet marketing) last, produced a OneBox result with only three business listings. Some local Adwords advertisements still appeared with their specific address on the fourth line, which as mentioned previously only displayed a city or state.

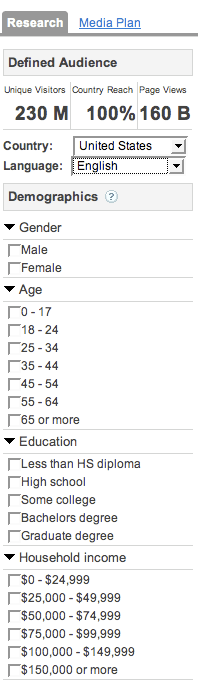

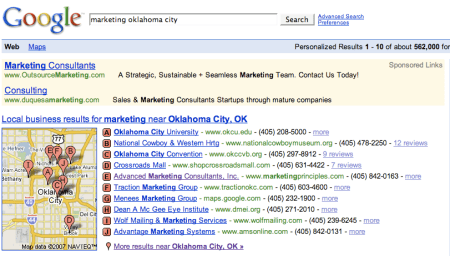

Google Local Business Results: Business Marketing Oklahoma City –

A slightly different search for a similar business category yields a new clue to at least one of the factors Google uses to generate its OneBox 10 local business listings.

A search for the service (business marketing) and the location (Oklahoma City) produces a different yet seemingly innocuous list of businesses. However, in this particular query and in addition to the expected listing for my business “Advanced Marketing Consultants” appearing, “Cohn, Tim” also appears as one of the results.

Cohn, Tim is one of my business phone listings in my local Bell telephone directory. The phone company apparently can’t sort and digitally publish business listings with an individual’s name like they can an individual’s residential phone data.

A search in YellowPages.com produces “Cohn, Tim” for my business phone number –

Yet, a search in Google for “Tim Cohn Oklahoma” produces both of my residential phone numbers and listings in correct order: Tim (first name) and then Cohn (last name) –

I haven’t investigated whether the phone company automatically reverses residential phone records before they are published to the web or whether Google reverses the data before they publish it.

Regardless, it looks like the business listing for “Tim Cohn” will remain forever memorialized in the vast telephone company data and its Internet counterpart as the business listing: “Cohn, Tim”.

Having accepted the fact that the telephone company seemed incapable of changing their listing results years ago, I decided to turn this particular piece of flawed data into my “control”.

When Cohn, Tim appears in print – whether online or off – its source is always local phone company data.

Thus at least a portion of this particular Google local OneBox list origins lies in business telephone directory data.

To its credit, Google has become proactive in allowing users to modify incorrect Google data as Barry Schwartz recently reported.

And unlike my attempts to get the phone company to correct how my business phone listing appears both in print and online, I am sure Google will let me append my business listing in their Google Local Business Center, but that will have to be the subject of another post.

Google Local Business Results: Chevy Oklahoma City –

Unlike with an old fashioned yellow pages search for listings with “Chevy Oklahoma City” keywords whether in the yellow pages or through directory assistance, Google can return results most likely relevant and matched to the searchers or callers intent.

Whereas, a yellow pages search or directory assistance call would take a couple of “passes” to yield the similarly accurate and desired result – businesses listings most likely to be known as “Chevy Oklahoma City”.

Brilliant!

If the telephone company can’t arrange and organize my single business listing correctly in their digital directories, how will they ever be able to compete with Google’s ability to anticipate and even provide multiple possible answers to each searchers question?

Google Local Business Results: Double Glazers Chelsea London (England) –

Google’s local business results aren’t just appearing in the US. A search for “double glazers” in the Chelsea section of London produces a list of double glazers midway down the search engine results page. I am not sure why some OneBox results appear at the top of the page and why others appear in the middle of the page but I believe it too must be based on Google’s understanding of the searchers intent.

Google Local Business Results: Travel Agents Sydney (Australia) –

This search in Sydney, Australia for travel agents also produces a OneBox result. Here the OneBox appears again at the top of the page above the organic results.

In my next post, I will show how Google’s local business results have taken a second step closer to bridging the gap between paid web search traffic and foot traffic…

You must be logged in to post a comment.